Maximize Your Savings: Electric Car Government Incentives You Need to Know

Going electric is a smart financial and environmentally responsible choice, especially if you can leverage government-backed incentives for electric cars. These programs, designed to promote the adoption of sustainable transportation, can significantly reduce the purchase price and make electric vehicle ownership more accessible. Many people are hesitant to make the switch to electric vehicles due to the upfront cost; however, a deeper look at government-sponsored incentives may help ease this transition. This article will explore various programs, highlight eligibility requirements, and provide a step-by-step guide to obtaining these savings. We will also cover the types of incentives available and how to maximize your savings.

Electric cars are becoming increasingly popular as more governments globally offer incentives to encourage their adoption. The financial benefits of these programs are attractive to a variety of consumer types. This guide will be broken down into sections addressing types of incentives, identifying eligibility criteria, and providing helpful tips for applying effectively.

Understanding Electric Car Government Incentives

Types of Incentives

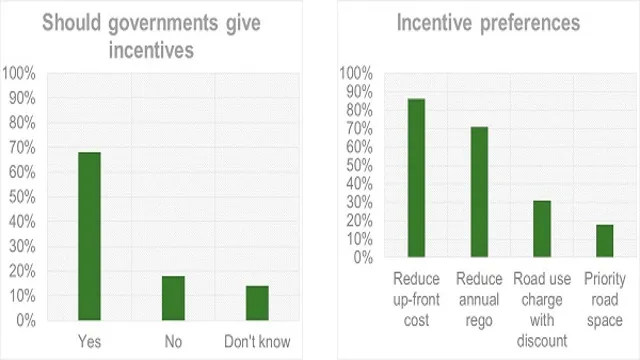

Government programs often include tax credits, rebates, and reduced registration fees, designed to offset the higher initial cost of electric vehicles compared to traditional gas-powered cars. These incentives are frequently tailored to support the adoption of electric vehicles, and incentivize the use of environmentally sound transport.

For instance, some areas provide grants for installing charging stations at home, helping to reduce the overall cost of transitioning to electric vehicles. These programs play a significant role in making electric vehicles more accessible to a wide range of consumers. Incentives vary geographically, so it’s critical to investigate the specifics in your area.

Eligibility Criteria

Eligibility criteria vary significantly. For instance, some programs might favor low-income households or those who meet certain environmental standards. Income limitations are a common criterion for eligibility. Specific models, vehicle types, or even geographic locations may also qualify an individual or household for a particular incentive. It’s essential to thoroughly review the guidelines provided by the governing body managing the incentives.

Identifying Your Eligibility

Researching Local Programs

The first step is to meticulously research the incentives available in your state or region. This often involves examining local government websites, contacting your state’s transportation department, or even reviewing federal agency websites for programs, to identify programs applicable to your specific area. Different areas may have various options for specific models, battery sizes, or vehicle types. Be aware that incentives are generally not the same from one location to the next.

Understanding Income and Other Factors

Government incentives often consider factors like income and household size. These considerations ensure that the benefits are distributed equitably. Often, low-to-moderate-income individuals may be eligible for higher rebates or tax credits. The factors can vary by program and by region. Be sure to familiarize yourself with these requirements for any program you want to take advantage of.

Maximizing Your Savings

Applying for Incentives

Applying for incentives often involves gathering specific documents, filling out forms, and submitting them to the designated authority. Specific forms and documentation will vary depending on the particular incentive. It’s essential to carefully review the guidelines provided by the government body overseeing the programs, as well as the exact deadlines for applying.

The application process usually involves providing proof of income, vehicle details, and other supporting documents. Understanding the application process ahead of time helps streamline the application process. This step-by-step procedure is designed to streamline the process.

Tips for Successful Applications

Be meticulous in your paperwork and ensure you accurately fill out all required documents. Seek assistance from financial advisors or automotive specialists if you’re unsure about any aspect of the application process. A qualified professional may be able to offer a wealth of information that can be very helpful. By following the directions meticulously, you can greatly enhance the likelihood of success in your application.

Additional Considerations

Combining Incentives

Many programs allow for combining different incentives. Combining federal, state, and local incentives can significantly reduce the overall purchase price of an electric vehicle. This is often overlooked by consumers.

Staying Informed

Keep an eye out for new or updated programs. This can involve checking government websites frequently for updates or checking with trusted sources of automotive information. Often, government programs are subject to adjustments and changes throughout the year.

Exploring Third-Party Options

Financial Institutions

Many financial institutions offer incentives or financing options for electric vehicle purchases. Research the offers of different financial institutions or dealerships, as they may be able to combine offers with other government incentives.

Third-Party Organizations

Some third-party organizations partner with governments to offer further incentives. Again, the terms and conditions need careful review to ensure compliance and legitimate offerings.

Future Trends in Incentives

Sustainability Focus

Governments are increasingly focused on supporting sustainable transportation. Look for incentives that support eco-friendly and sustainable travel choices. These programs are increasingly attractive to environmentally conscious consumers.

Technological Advancements

As electric vehicle technology advances, incentives may adjust to reflect new developments and consumer demands. The range and performance of vehicles may play a greater role in determining eligibility for incentives, potentially leading to greater flexibility.

Conclusion of the Electric Vehicle Incentive Landscape

Government incentives are crucial factors for potential EV purchasers. They help to offset the higher initial price of electric vehicles.

Call to Action

To take advantage of these substantial savings, begin your research by visiting your local government website and carefully reviewing the criteria for incentives available in your area. Consult with a trusted financial advisor if needed to understand how the various incentives might fit your financial situation.

Conclusion of the Electric Vehicle Incentive Landscape

Maximizing electric vehicle savings is a multifaceted process involving diligent research, understanding eligibility requirements, and carefully evaluating third-party offers. By following this step-by-step guide, you can confidently leverage the available incentives and potentially save substantial amounts of money on your electric vehicle purchase.

Conclusion of the Electric Vehicle Incentive Landscape

Government incentives remain a crucial component for potential EV purchasers. They are designed to offset the often higher initial costs of electric vehicles compared to traditional gas-powered vehicles.

Call to Action

Begin your research by visiting your local government website and thoroughly reviewing the criteria for available incentives in your area. Don’t hesitate to seek advice from a financial advisor to ensure the incentives align with your financial situation and objectives. These incentives offer significant savings on electric vehicles, enabling you to embrace a greener future.

Frequently Asked Questions

What are the most common electric car government incentives?

Government incentives for electric cars often include tax credits, rebates, and reduced registration fees. These vary considerably by region and even state within a nation; some locations offer grants for charging station installation. There are also often various promotional programs in place for different manufacturers or models; do your research on the specific programs available in your area.

How do I determine if I am eligible for electric car incentives?

Eligibility requirements for government incentives often depend on factors like your income, household size, or the vehicle’s specifications. Check with the relevant government agency or your state’s department of transportation or revenue to review the specific regulations and requirements in your area. Make sure to verify the details for current financial years and policies.

How do I apply for these electric car government incentives?

The application process for electric car government incentives usually involves gathering necessary documents, completing forms, and submitting them to the designated authority. It’s crucial to carefully review the guidelines for proper documentation and ensure compliance with the specific regulations.

Can I get more electric car government incentives through third-party companies?

Often, third-party organizations or financial institutions partner with governments to offer additional incentives for electric car purchases. Be mindful to ensure that such incentives comply with the governing laws of your region; scrutinize the source carefully to ascertain the legitimacy of these programs.

In summary, maximizing your savings on electric cars through government incentives is a smart financial move. Understanding the various programs and eligibility criteria is key to securing these benefits. By researching the incentives available in your area, and consulting with financial experts if needed, you can significantly reduce the upfront cost of purchasing an electric vehicle and contribute to a greener future. Don’t miss out on the potential savings; research your local incentives today!